Nowadays, securing one’s future and protecting their life from financial constraints has become a necessity. In this series, it’s remarkable to note that a Life Insurance policy can be an aid to safeguard you and your family’s future.

But, it is also a huge challenge to pick one of the most suitable plans for an individual. There are various different kinds of life insurance policies offered by numerous life insurance providers in the market. But which type of life insurance in India will work for you, let us know in this article.

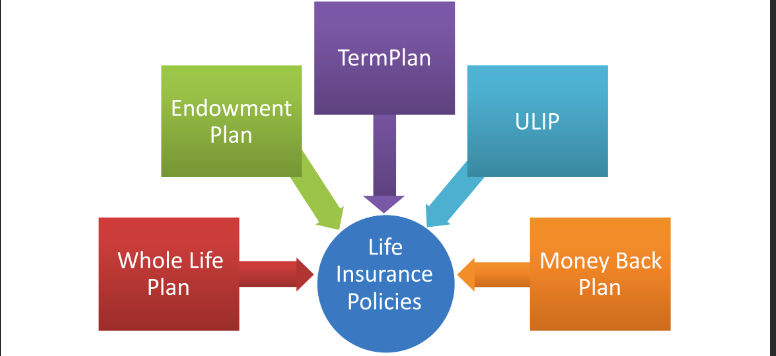

What are the different Types of Life Insurance in India?

These are the common types of investment plans that insurance providers in India have to offer you. Read below the specifications of different types of life insurance in India:-

| Term Life Insurance Plan |

- Term life insurance provides the beneficiaries of a policy the compensation amount upon the demise of the policyholder. It can be bought for ideally 10, 20, or 30 years of time period.

- Several other life insurance policies offer maturity benefits to the policyholder hence their premiums used to be higher comparatively than a term life insurance, as it doesn’t offer additional benefits or larger coverage.

|

| Whole Life Insurance Plan |

- It provides the policyholders a lifetime coverage in terms of a death benefit which is basically a saving component.

- It secures the whole life of a policyholder even if he is met with an unforeseen demise. In this case, the beneficiaries of his policy will benefit.

|

| Endowment Policy |

- An endowment plan provides the pay-out to the policyholders if he/she survives till the completion of the policy or maturity period.

- In comparison with other life insurance plans, this is a bit heavy on your pockets but returns broader benefits that can even cover your child’s higher education, property purchase, marriage, etc.

|

| Money-back Insurance Plan |

- This plan precisely returns the value of premiums paid by you in the form of a guaranteed regular income source.

- More than this, a policyholder is eligible to get some bonuses for the fulfilment of their interim needs, especially declared by the insurance company.

|

| Retirement Insurance Plan |

- Once you go beyond the fixed regular salary credits or retire from a job, this plan fits in, as an income source for you to get regular or monthly pay-outs.

- The premiums that you have paid to the insurer till the policy was active, will return back to you on a monthly basis from the accumulated sum after getting retired.

|

| Unit Linked Insurance Plans (ULIPs) |

- ULIPs are not only beneficial for the protection and creation of wealth, but they also provide live benefits according to market standard returns.

- But if in case the policyholder dies due to some unforeseen event, the beneficiaries of the insured will receive the lump sum amount of the policy.

|

| Child Insurance Plans |

- Policyholders basically start investing in the plan when his/her child is an infant in order to secure the child’s future.

- Where in a case, if some mishap has been caused to the insured, the child will get the death benefits to fulfill his monetary requirements.

|

| Group Life Insurance |

- This kind of insurance is generally offered by the employer of the company to its employees.

- This is helpful in saving them under any unforeseen event and securing them till they’re connected with the company’s policy.

|

| Term Insurance with Return of Premium |

- In this type of life insurance plan, the policyholder gets survival benefits.

- And the premiums that he/she has paid to the insurance company is returned back to the policyholder after deducting the GST.

|

Conclusion

Life Insurance has been working as a wonder for those who want to secure their life-long financial constraints and live a worry-free life. In this era of technology, you can purchase a policy online even sitting at your home.

So what are you waiting for? Give yourself a chance to relive the future and call the trusted advisors of PolicyX.com to learn more about a suitably personalized plan for you.