Few statistics in the realm of personal finance are as important as your credit score. Whether you’re looking for a mortgage, a vehicle loan, or even setting up utility services, your credit score is crucial in deciding your financial options. This post will walk you through the Credit Score Clinic, assisting you in better understanding and improving your credit score.

Credit Scores’ Importance

Your credit score is more than a three-digit figure; it’s a financial snapshot used by lenders to assess your creditworthiness. Understanding its importance is the first step towards financial independence. Importance of Credit Score Understanding and improving how to evaluate and improve your credit score can lead to lower interest rates, greater borrowing capacity, and overall financial well-being.

Definition and Fundamentals

A credit score is a numerical representation of your creditworthiness that is computed using information from your credit history and other financial behaviours. It provides lenders with a rapid assessment of the risk of giving loans to you. Credit ratings are normally between 300 and 850, with higher scores indicating greater creditworthiness. Each range has a different impact on your financial prospects.

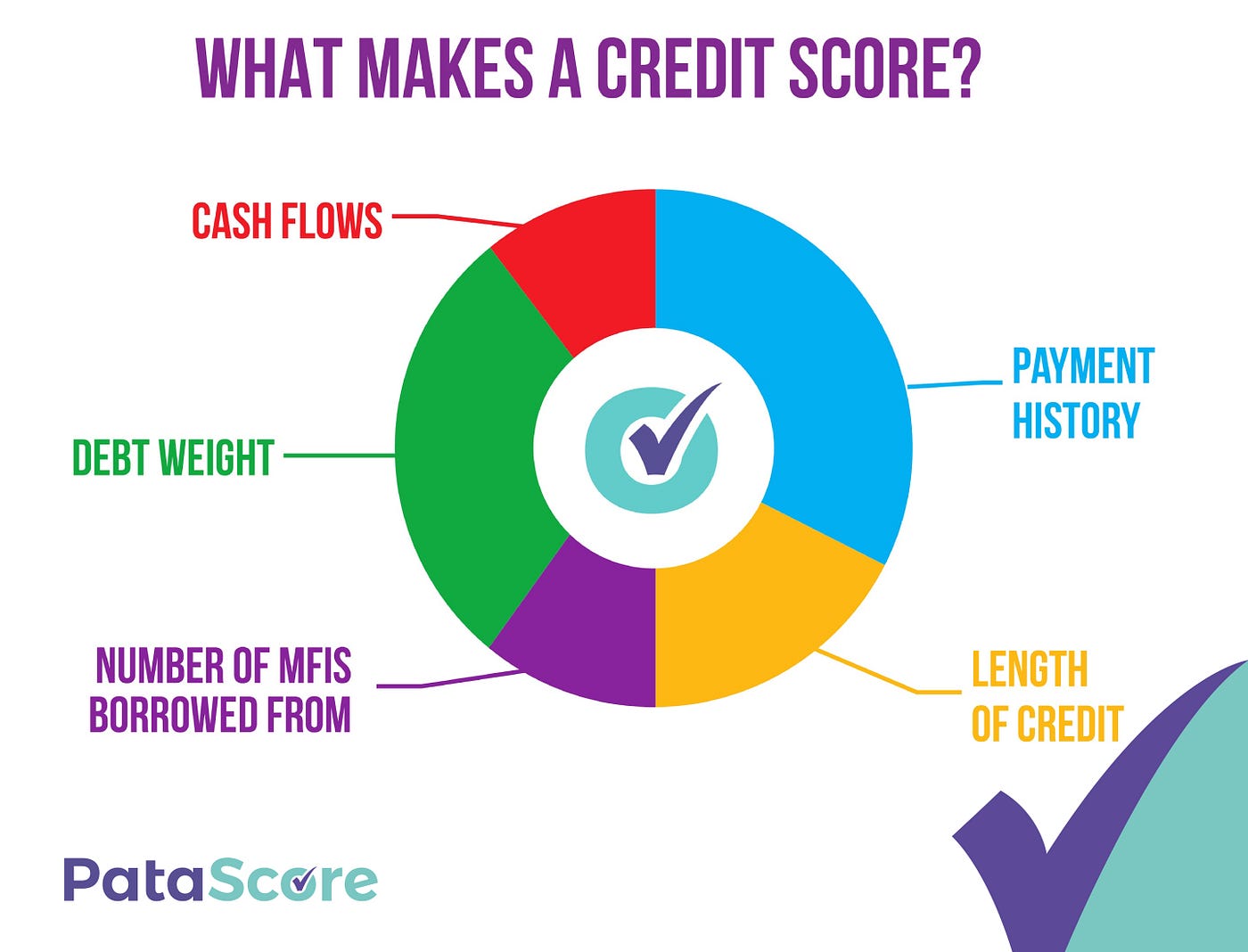

Credit Score factors

Understanding the factors that influence your credit score, such as payment history, credit utilisation, and credit history length, allows you to take specific activities to enhance it. Influence on Loan Approvals is a higher credit score enhances the likelihood of loan acceptance, making it easier to obtain finance for significant life events such as purchasing a home or starting a business.

Interest Rate Influence

Your credit score has a direct impact on the interest rates you are offered. Over the course of a loan, a strong credit score can save you hundreds of dollars in interest. Financial Opportunity Role is a good credit score that improves your financial chances beyond loans, such as lower insurance rates, rental approvals, and even work opportunities.

Determine Your Credit Score

The importance of consistent monitoring and checking your credit score on a regular basis allows you to detect mistakes, resolve possible difficulties quickly, and track your progress towards better financial health.

Access to Credit Reports for Free Many firms provide free credit report access, allowing you to keep informed without incurring additional charges. Understanding Your Credit Score Deciphering your credit report may appear difficult, but breaking down the essential elements such as credit accounts, inquiries, and public records provides valuable insights.

Common Credit Score Misconceptions

Myth versus reality: dispelling common credit score myths allows you to navigate your financial journey with correct knowledge. Common Credit Score Myths This section tackles misunderstandings that may affect your credit score, ranging from closing credit cards to ignoring your credit report.

Responsible Credit Building

Balanced credit use and avoidance of needless debt are hallmarks of competent credit management. Understanding the narrow line between using credit to build your business and falling into debt is critical for long-term financial success.

How to Improve Your Credit Score

Bill payments made on time are critical to keeping a good credit score. Learn how to stay on top of deadlines and avoid late payments. Credit Card Balance Management is Effective in credit card balance management and can improve your credit utilisation ratio. Which is a major aspect in credit score calculations. While credit diversification is beneficial, opening too many accounts in a short period of time can harm your credit score.

Beginnings: College and Early Career

Developing solid credit habits early in life lays the groundwork for financial success, particularly during college and the early phases of your job. Maintaining a solid credit score while you navigate homeownership and family life is critical for receiving favourable terms on mortgages and other loans.

Recognizing Credit Utilisation

Credit utilisation, or the ratio of credit card balances to credit limits, has a substantial impact on your credit score. Credit consumption must be managed intelligently in order to preserve a healthy credit profile.

Making Plans for Retirement

Even after retirement, your credit score influences financial decisions. This section looks at how credit affects your golden years. Examples of Actual Score Improvement Insights and motivation can be gained from hearing inspiring success stories from people who have successfully raised their credit scores.

Influence of Credit on Interest Rates

Lower interest rates on loans and credit cards might result from good credit. Lenders give favorable rates to consumers with excellent credit, making maintaining a positive credit history financially advantageous.

Others’ Strategies

Explore particular tactics that have proven beneficial in the route to better credit, such as debt consolidation and appropriate credit card use. Seeking Professional Credit Repair Assistance Professional help can make a difference. Learn more about how credit counselling programmes might help you.

Credit Repair Legal Approaches

Understanding your rights and legal credit repair options allows you to make informed decisions on your credit improvement path. As technology improves, so does the credit assessment landscape. Investigate the rising trends that will shape the future of credit ratings.

Credit Reporting Technological Advancements

Technology is changing the way credit reporting works, from alternate data sources to creative scoring methods.

Conclusion

Understanding and enhancing your credit score is a worthwhile trip at the Credit Score Clinic. You have the ability to design a better financial future if you are equipped with knowledge and practical strategies. Don’t let your credit score be a mystery any longer—take charge today.

FAQs

What credit score range is ideal?

Typically, the ideal credit score range is between 700 and 850, signifying outstanding creditworthiness.

How frequently should I check my credit report?

It is recommended that you review your credit score on a regular basis, with at least an annual check to ensure accuracy and uncover any difficulties.

Can I quickly raise my credit score?

While it takes time to improve, timely bill payments and prudent credit management can produce reasonably immediate effects.

Late payment affect my credit score?

Late payments can have a substantial influence on your credit score, perhaps leading to higher interest rates and diminished creditworthiness. Credit repair firms might be useful in some cases, but it is critical to select reliable and legitimate services.