Binance Coin (BNB) has gained significant popularity in the world of cryptocurrencies. It’s not just a digital asset but also plays a vital role within the Binance ecosystem. As a trader or investor, understanding Binance Coin’s price movements and trading signals is crucial for making informed decisions. In this comprehensive guide, we’ll delve into Binance Coin (BNB/USD) trading signals, helping you navigate this exciting market.

What Is Binance Coin (BNB)?

Binance Coin, often referred to as BNB, is the native cryptocurrency of the Binance exchange, one of the largest and most well-known cryptocurrency exchanges globally. BNB serves multiple purposes, including paying trading fees, participating in token sales on the Binance Launchpad, and more. Understanding its utility is essential to grasp its trading dynamics. In addition to understanding the utility of BNB, keeping an eye on crypto signals can be valuable, especially if you’re looking for crypto signals free of charge. These signals, which can be found through various sources, can provide insights into potential trading opportunities and market trends, helping you make more informed decisions when trading Binance Coin or any other cryptocurrency.

Binance Coin’s Price History

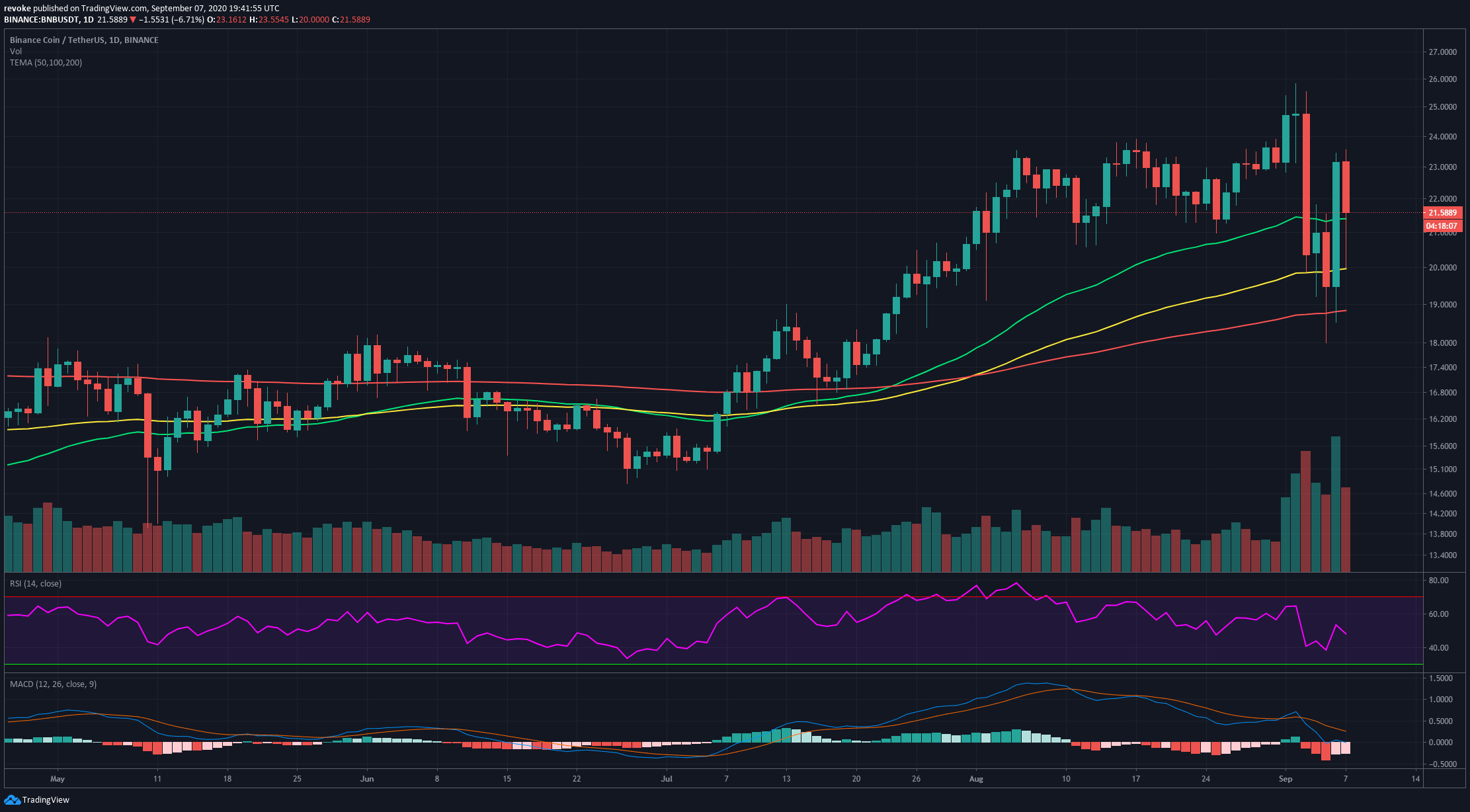

Before diving into trading signals, it’s essential to look at Binance Coin’s price history. BNB has experienced significant volatility since its inception in 2017, with notable price surges and corrections. Analyzing historical price data can provide insights into potential future movements.

Technical Analysis of Binance Coin

Technical analysis involves studying historical price charts, patterns, and indicators to predict future price movements. For Binance Coin, traders use tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify trends, support, and resistance levels. These indicators offer valuable signals for making trading decisions.

Fundamental Factors Influencing Binance Coin

Fundamental analysis focuses on evaluating the intrinsic value of an asset based on various factors. When it comes to Binance Coin, factors like Binance’s developments, adoption, and regulatory changes can significantly impact its price. Keeping an eye on these fundamentals is essential for long-term investors. Additionally, for those looking to make timely trading decisions, it’s important to complement fundamental analysis with technical analysis tools and binance buy sell signals. These signals, often available through trading platforms or third-party services, can provide real-time information on when to buy or sell Binance Coin based on technical indicators and market conditions, helping traders navigate the cryptocurrency market more effectively.

Trading Signals for Binance Coin

Now, let’s explore some common trading signals for Binance Coin:

- Moving Averages: Traders often use moving averages to identify trends. A “golden cross,” where a short-term moving average crosses above a long-term moving average, can signal a bullish trend. Conversely, a “death cross” indicates a bearish trend.

- RSI (Relative Strength Index): RSI measures the speed and change of price movements. An RSI above 70 suggests the asset is overbought, potentially signaling a reversal. An RSI below 30 indicates oversold conditions, suggesting a potential buying opportunity.

- Bollinger Bands: Bollinger Bands help identify volatility and potential price breakouts. When the price approaches the upper band, it may be overextended, signaling a possible correction. Conversely, when it approaches the lower band, it might indicate a buying opportunity.

- Volume Analysis: Pay attention to trading volume. A price increase with high trading volume is more likely to be sustained than one with low volume, which could be a sign of a speculative move.

- News and Events: Stay updated with Binance-related news, partnerships, and developments. Positive news can drive Binance Coin’s price higher, while negative news can lead to corrections.

- Support and Resistance Levels: Identify key support and resistance levels on Binance Coin’s price chart. These levels can act as barriers or catalysts for price movements.

- Candlestick Patterns: Candlestick patterns like doji, hammer, and engulfing patterns can provide insights into potential reversals or continuations in price trends.

- Fibonacci Retracement: Fibonacci retracement levels help identify potential price reversals. Traders use these levels to set entry and exit points.

- MACD (Moving Average Convergence Divergence): MACD is a momentum indicator that can signal bullish or bearish trends. Crosses above or below the signal line provide valuable signals.

- Social Media Sentiment: Monitor social media platforms and forums for discussions and sentiment around Binance Coin. Positive sentiment can drive demand, while negative sentiment can lead to selling pressure.

Risk Management in Binance Coin Trading

Effective risk management is crucial when trading Binance Coin or any cryptocurrency. Here are some key principles to follow:

- Set Stop-Loss Orders: Define a predetermined point at which you’ll exit a trade to limit potential losses.

- Diversify Your Portfolio: Avoid putting all your funds into a single asset. Diversification can help spread risk.

- Use Proper Position Sizing: Determine the size of your position based on your risk tolerance and overall portfolio size.

- Stay Informed: Continuously educate yourself about cryptocurrency markets and stay updated with the latest news and developments.

Long-Term vs. Short-Term Trading Strategies

Consider your trading goals when choosing a strategy. Long-term investors may focus on Binance Coin’s fundamentals, while short-term traders may use technical analysis and trading signals for quick gains.

Binance Coin Wallets and Security

Ensure the security of your Binance Coin holdings by using reputable wallets and following best practices for protecting your assets.

Regulations and Taxation

Understand the legal and tax implications of trading Binance Coin in your jurisdiction. Compliance with regulations is essential to avoid legal issues.

Conclusion

Trading Binance Coin (BNB/USD) can be both exciting and profitable. By understanding Binance Coin’s utility, analyzing its price history, and using technical and fundamental analysis, you can make informed trading decisions. Remember to implement risk management strategies, choose an appropriate trading timeframe, and stay informed about the latest developments in the cryptocurrency market. With diligence and knowledge, you can navigate the Binance Coin market effectively.